Choosing the right investment fund legal entity structure is one of the most consequential legal decisions a fund manager will make. An inappropriate structure can lead to regulatory breaches, tax inefficiencies, investor dissatisfaction, and operational constraints. Yet, fund structuring is often treated as a technical afterthought rather than a strategic legal exercise. This guide provides fund managers with a practical, legally grounded explanation of investment fund legal entity structures, helping them align regulatory compliance, investor expectations, and long-term growth objectives.

What Is an Investment Fund Legal Entity Structure?

An investment fund legal entity structure refers to the legal form through which a fund is established, governed, and operated. It determines how capital is pooled, how investors participate, how liability is allocated, and how the fund interacts with regulators and tax authorities.

Crucially, the fund itself is typically a separate legal vehicle, distinct from the fund manager or investment adviser.

A well-designed fund legal entity structure clearly defines the roles and responsibilities of each party, including:

- General Partner (GP): Manages the fund and bears ultimate responsibility

- Limited Partners (LPs): Passive investors with limited liability

- Fund Manager / Investment Manager: Makes investment decisions

- Investment Adviser: Provides advisory services (often cross-border)

- Administrator, Custodian, Auditor: Ensure operational integrity and compliance

Clear allocation of duties is essential for regulatory approval and risk management.

Common Types of Investment Fund Legal Entity Structures

1. Plain Vanilla Offshore Fund Structure (Offshore Fund + HK Manager)

The plain vanilla fund structure is the most straightforward and widely used offshore fund arrangement involving Hong Kong fund management. Under this model, the fund is established offshore—most commonly as a Cayman Islands exempted company—while discretionary portfolio management is carried out by a Hong Kong-based fund manager.

From a regulatory perspective, where portfolio management activities are conducted in Hong Kong, the fund manager is generally required to hold a Type 9 SFC licence.

2. Segregated Portfolio Company (SPC)

A Segregated Portfolio Company (SPC) is a specialized offshore fund structure, most commonly established under the Cayman Islands SPC regime, and is particularly popular among hedge fund platforms and multi-strategy managers.

An SPC is a single legal entity that may create multiple segregated portfolios, each of which is legally ring-fenced from the others. Key legal characteristics include:

- Statutory segregation of assets and liabilities

- Creditors of one portfolio have no recourse to other portfolios

- Centralized governance with portfolio-level accounting

From a practical standpoint, the segregated portfolio company fund structure allows investors to allocate capital to specific strategies, geographies, or asset classes within the same legal vehicle, improving operational efficiency and cost management.

3. Limited Partnership Fund Structure (GP–LP Model)

The limited partnership fund structure remains the market standard for private equity, venture capital, and closed-ended alternative funds.

Under this model:

- The fund is constituted as a limited partnership

- The general partner (GP) is typically incorporated as a limited company

- Limited partners (LPs) enjoy limited liability

- Portfolio management is delegated to a Hong Kong Type 9 licensed fund manager

The contractual flexibility of the Limited Partnership Agreement (LPA) allows bespoke governance, economics, and investment restrictions, making this structure highly attractive to institutional investors.This structure closely mirrors Cayman Islands exempted limited partnerships while allowing Hong Kong-based managers to centralize management functions.

4. Limited Partnership Fund Structure with LP Advisory Committee

A more sophisticated variation of the GP–LP model includes the establishment of an LP Advisory Committee (LPAC), typically composed of key institutional limited partners. Key features include:

- Advisory oversight on conflicts of interest

- Review of related-party transactions

- Input on valuation matters and fund term extensions

While the LPAC does not manage the fund, its presence significantly enhances governance and investor confidence. This structure is commonly adopted in institutional private equity funds, where transparency and alignment of interests are critical.

Private Open-ended Fund Company (OFC)

The Open-ended Fund Company (OFC) is a Hong Kong–domiciled corporate fund vehicle established under the Securities and Futures Ordinance (Cap. 571) and regulated by the Hong Kong Securities and Futures Commission (SFC). It was introduced to provide fund managers with an onshore alternative to offshore corporate funds, while maintaining flexibility comparable to Cayman Islands investment companies.

An OFC is a separate legal entity with variable share capital, allowing shares to be issued and redeemed at net asset value (NAV), making it particularly suitable for open-ended investment strategies. In Hong Kong, this structure is primarily used for publicly offered mutual funds, ETFs, and private Hedge Funds.

Key Legal Features of an OFC Structure

From a legal structuring perspective, an OFC has the following defining characteristics:

- Incorporated as a corporate entity, not a partnership or trust

- Managed by a Board of Directors who owe fiduciary duties to the company

- Must appoint an SFC-licensed or registered investment manager

- Variable share capital enabling continuous subscription and redemption

- Assets are held by an independent custodian

- Subject to ongoing SFC supervision and reporting

Unlike traditional companies, capital maintenance rules under the Companies Ordinance do not apply, which allows efficient investor redemptions.

Typical OFC Fund Structure

A standard OFC legal entity structure comprises:

- OFC (Fund Vehicle) – incorporated in Hong Kong

- Investment Manager – Hong Kong entity holding a Type 9 SFC licence

- Custodian – independent and SFC-compliant

- Board of Directors – responsible for oversight and governance

- Company Secretary – must be a HK resident or company

The investment manager carries discretionary portfolio management functions, while the OFC remains the legal owner of fund assets.

Regulatory and Licensing Considerations for OFCs

A critical legal requirement is that the OFC must appoint an eligible investment manager. For Private OFCs, this manager generally must be licensed or registered for Type 9 (asset management) by the SFC. Overseas delegates are permitted, but the primary responsibility usually sits with the HK-licensed entity to ensure “substance” in Hong Kong.

The SFC also imposes requirements relating to:

- Risk management

- Valuation policies

- Disclosure and reporting

- Ongoing compliance monitoring

Limited Partnership Fund (LPF)

The Limited Partnership Fund (LPF) is a Hong Kong–domiciled partnership fund vehicle established under the Limited Partnership Fund Ordinance (Cap. 637). It was designed primarily for private equity, venture capital, and other closed-ended alternative investment funds.

Unlike an OFC, an LPF does not have a separate legal personality. Instead, it operates through contractual arrangements governed by a Limited Partnership Agreement (LPA).

Key Legal Features of an LPF Structure

- At least one General Partner (GP)

- One or more Limited Partners (LPs)

- Governance governed primarily by the LPA

- No restriction on capital commitments or drawdowns

- No statutory investment or borrowing restrictions

The flexibility of the LPF regime closely mirrors offshore limited partnerships, particularly Cayman Islands exempted limited partnerships.

Typical LPF Fund Structure

A standard LPF legal entity structure comprises:

- LPF (Fund Vehicle) – registered in Hong Kong

- General Partner – often a Hong Kong or offshore company

- Investment Manager – typically a Hong Kong entity with a Type 9 licence

- Limited Partners – institutional and professional investors

The GP enters into an investment management agreement with the licensed fund manager, delegating portfolio management functions.

LP Advisory Committee and Governance Enhancements

Many LPFs establish an LP Advisory Committee (LPAC), usually comprising key institutional LPs. The LPAC typically advises on:

- Conflicts of interest

- Valuation issues

- Related-party transactions

- Extensions of fund term

From a legal perspective, LPACs enhance investor confidence while preserving GP control.

Regulatory and Compliance Considerations for LPFs

While the LPF itself is not licensed by the SFC, regulatory obligations arise at the manager level. Key compliance points include:

- Investment Manager: An IM must be appointed to manage day-to-day affairs. If the IM conducts regulated activities in Hong Kong, a Type 9 SFC licence is required.

- Responsible Person: The GP must appoint a statutory Responsible Person (e.g., a lawyer, accountant, or licensed corporation) to strictly carry out AML/CTF measures.

- Annual Filings: The LPF must file an Annual Return with the Companies Registry (distinct from corporate audits).

- Safe Harbours: LPs must rely on statutory Safe Harbour provisions (e.g., acting on an LPAC) to ensure they do not accidentally assume management liability.

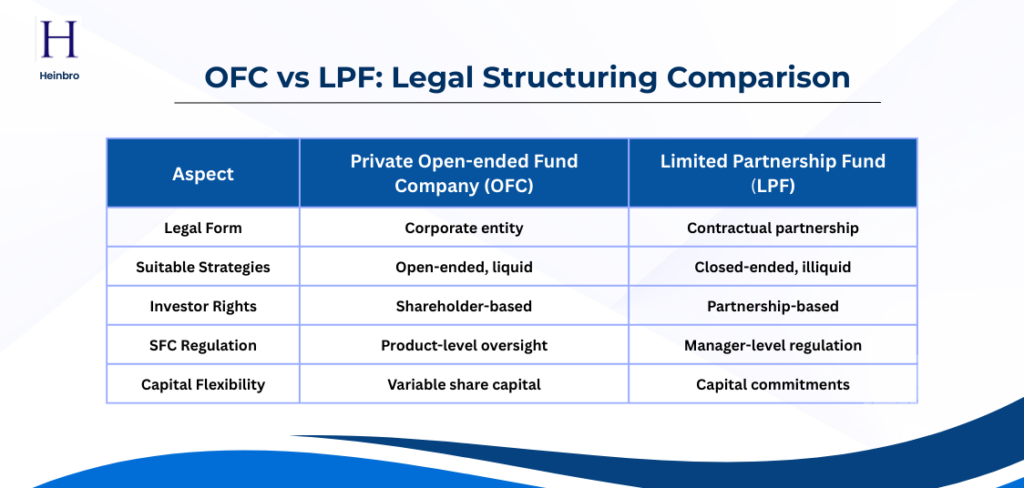

OFC vs LPF: Legal Structuring Comparison

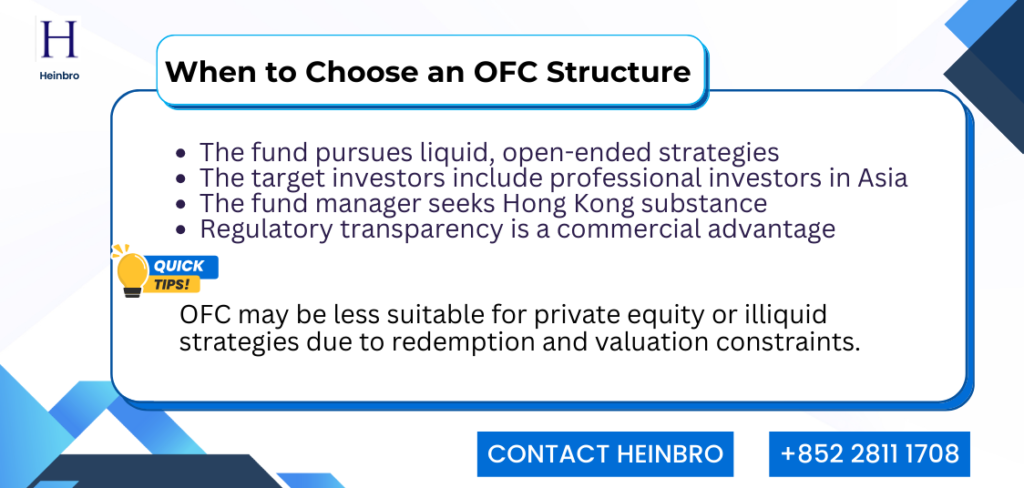

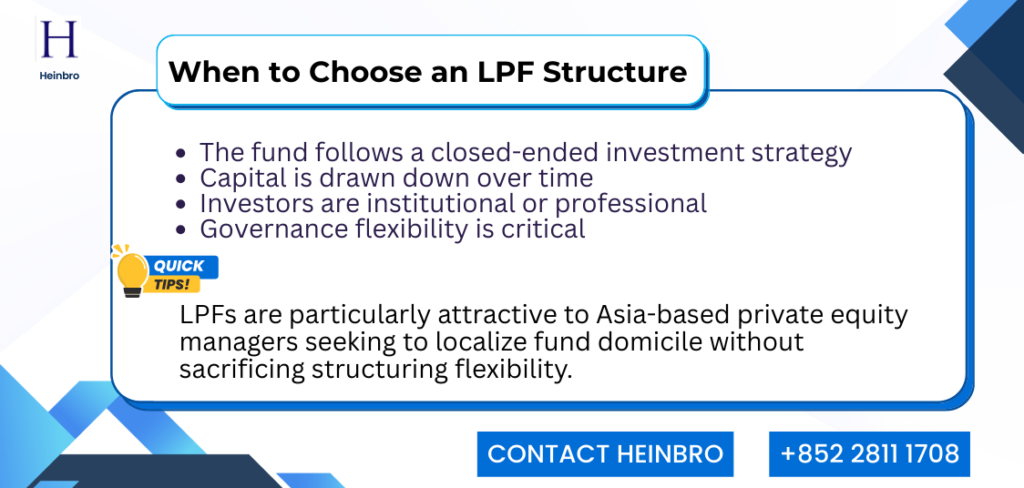

Choosing between an OFC and an LPF is not merely a legal formality. Fund managers must evaluate:

- Investment liquidity profile

- Investor expectations

- Regulatory cost and disclosure tolerance

- Tax neutrality and cross-border implications

- Long-term scalability

Early legal and compliance input is critical to avoid costly restructuring.

Optimising Fund Structures for Long-Term Success

An effective investment fund legal entity structure is foundational to the success of any fund. Beyond meeting regulatory requirements, the chosen structure directly influences investor confidence, governance effectiveness, and the fund’s ability to scale efficiently across jurisdictions. Whether a fund adopts an offshore vehicle with Hong Kong-based management, an Private Open-ended Fund Company (OFC), or a Limited Partnership Fund (LPF), early and informed structuring decisions are critical to long-term sustainability.

Heinbro advises fund managers at every stage of the fund lifecycle, with particular strength in Registration of Private Open-Ended Fund Companies (OFCs) and Registration of Limited Partnership Funds (LPFs) in Hong Kong. Combining deep regulatory expertise with practical, hands-on execution, Heinbro provides one-stop compliance services for Hong Kong financial firms, supporting fund establishment (licensing, OFC and LPF registration, and immigration), ongoing operations (compliance management, SFC inspection support, and professional training), and strategic growth through recruitment and resourcing solutions.

Contact Heinbro via heinbro@heinbro.com or +852 2811 1708.