What happens if a firm gets its SFC licensing wrong? Misclassifying an intermediary or licensed individual can quickly lead to regulatory action and reputational risk. Drawing on Heinbro’s long-standing compliance experience in Hong Kong, this guide explains the SFC’s licensing framework and uses a case study of an overseas asset management group carrying on Type 9 (asset management) regulated activity in Hong Kong to show how the SFC assesses what firms actually do in practice, and why early, well-planned licensing matters.

What’s Licensed Corporations and Licensed Individuals

Under the Securities and Futures Ordinance (Cap. 571) (SFO), the SFC regulates intermediaries carrying on regulated activities in Hong Kong. The classification of types of intermediary and licensed individual determines licensing scope, supervisory responsibility, and personal accountability.

The SFC framework distinguishes between:

- Corporate intermediaries, which conduct regulated activities as entities; and

- Licensed individuals, who perform regulated functions on behalf of intermediaries.

Correct classification is essential, as each category carries distinct compliance, governance, and enforcement implications.

Types of SFC Licensed Corporations

1. Full SFC Licensed Corporations

A full licensed corporation is the most common type of intermediary under SFC licensing. These entities are authorised to carry on one or more regulated activities on a continuous basis.

Key compliance features include:

- Appointment of at least two Responsible Officers for each regulated activity

- Maintenance of financial resources in accordance with the Financial Resources Rules

- Ongoing compliance with conduct, internal control, and reporting obligations

This type of intermediary is typically adopted by asset managers, securities brokers, and advisory firms with a long-term Hong Kong presence.

2. SFC Registered Institutions

Registered institutions are authorized financial institutions (typically banks) regulated primarily by the Hong Kong Monetary Authority (HKMA) but registered with the SFC to conduct regulated activities.

Key distinctions:

- Dual regulatory oversight (HKMA + SFC)

- Modified licensing mechanics compared to licensed corporations

- Strong emphasis on group-wide governance and risk management

Understanding this type of intermediary and licensed entity is critical for banking groups expanding into securities or asset management activities.

Types of SFC Licensed Individuals

1. Responsible Officers (ROs)

Responsible Officers (ROs) are the most critical type of licensed individual under the SFC regime. They are personally accountable for the management and supervision of regulated activities.

Regulatory expectations include:

- Sufficient authority within the organization

- Demonstrable industry experience and competence

- Personal liability for compliance failures

From an enforcement perspective, the SFC frequently targets Responsible Officers when governance breakdowns occur.

2. Licensed Representatives (LRs)

Licensed Representatives are authorised to carry on regulated activities on behalf of a licensed corporation.

Key compliance considerations include:

- Activities must fall strictly within the firm’s licensed scope

- Continuous fit-and-proper assessment

- Mandatory ongoing training and competence requirements

Licensed Representatives form the operational backbone of most Type 9 licensed firms.

Heinbro Case Study: Licensing Structure for an Overseas Asset Management

An overseas asset management group with an established track record in its home jurisdiction sought to establish a regulated presence in Hong Kong to conduct discretionary asset management activities for professional investors.

The firm’s Hong Kong activities were limited to investment decision-making and portfolio management, while custody, settlement, and client asset holding functions would be performed by independent third-party custodians.

Accordingly, the firm proposed to apply for Type 9 (asset management) regulated activity subject to a licensing condition restricting it from holding client assets.

Applying for SFC Type 9 and Structuring a Full Licensed Corp

Following an initial regulatory assessment, the proposed activities were characterised as Type 9 (asset management) regulated activity under the SFO. As the applicant was not an authorised financial institution, the appropriate structure was a Full SFC Licensed Corporation under section 116 of the SFO.

At the application stage, the SFC’s fit-and-proper assessment extended beyond the applicant entity to its controllers, senior management, and proposed Responsible Officers. The firm submitted detailed information on:

- Group structure and regulatory history

- Senior management and personnel qualifications

- Internal governance and compliance arrangements

All policies were aligned with the SFC’s Fit and Proper Guidelines and Guidelines on Competence.

1. Incorporation and Corporate Structure

The firm incorporated a Hong Kong subsidiary to act as the licensed entity. This structure allowed:

- clear regulatory accountability at the Hong Kong level;

- direct supervision by locally approved Responsible Officers; and

- effective enforcement of SFC requirements relating to records, inspections, and ongoing compliance.

The corporate structure and reporting lines were documented in a board-approved organisational chart submitted with the licence application.

2. Governance, Senior Management, and MICs

Consistent with SFC expectations, senior management responsibility was clearly allocated across:

- directors of the licensed corporation;

- Responsible Officers; and

- Managers-In-Charge (MICs) of Core Functions, including Overall Management Oversight and Key Business Line.

Each MIC formally acknowledged their appointment and responsibilities. The board approved the management structure and established procedures to ensure that any subsequent changes to MIC appointments or particulars would be notified to the SFC within the prescribed timeframe.

3. Appointment of Responsible Officers

Two Responsible Officers were appointed for Type 9 regulated activity, each with substantial Hong Kong asset management experience.

Key considerations included:

- ensuring that at least one Responsible Officer was an executive director of the licensed corporation;

- demonstrating that Responsible Officers possessed real authority over investment decision-making and risk management; and

- avoiding “name-only” appointments by clearly documenting supervisory responsibilities.

All Responsible Officer applications were submitted together with the licence application, enabling the SFC to assess governance holistically.

4. Financial Resources: Capital and Liquidity in the Case Study

In line with prevailing market practice, the firm applied for Type 9 (asset management) regulated activity subject to a licensing condition restricting it from holding client assets. This approach reflects how most boutique asset management firms operate in practice, whereby discretionary portfolio management is conducted in Hong Kong, while custody, settlement, and client asset holding functions are outsourced to independent third-party custodians. As a result, the firm was subject to a minimum liquid capital requirement of HKD 100,000 under the Securities and Futures (Financial Resources) Rules.

5. Six-Month Operating Expense Projection

As a newly licensed firm, the applicant was required to demonstrate that it had sufficient financial resources to commence and maintain operations. A detailed projection of operating expenses for the first six months post-licensing was submitted.

Where projected expenses exceeded excess liquid capital, the firm provided:

- a documented funding plan; and

- evidence of shareholder support to ensure that additional capital would be injected when required.

This approach addressed the SFC’s focus on financial sustainability, rather than formal capital compliance alone.

6. Internal Controls and Competence

The SFC examined whether the firm’s internal control framework was proportionate to its proposed activities. Particular attention was paid to:

- investment decision-making processes;

- conflict management and disclosure;

- risk management and valuation controls; and

- compliance monitoring and reporting lines.

Policies were aligned with the Code of Conduct and the Management, Supervision and Internal Control Guidelines, with clear implementation responsibility assigned to senior management.

Regulatory Outcome and Compliance Benefits

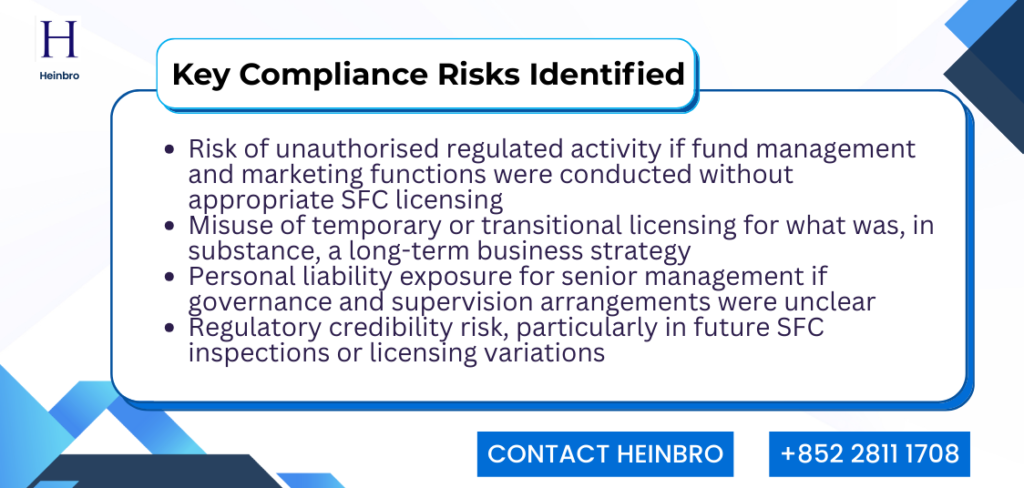

By aligning its operational structure with the correct types of intermediary and licensed individual, the firm achieved the following outcomes:

- Regulatory clarity: Licensing accurately reflected business substance

- Reduced enforcement risk: Clear boundaries around regulated activities

- Proportionate capital requirements: HKD 100,000 liquid capital aligned with a no-client-asset model

- Scalable compliance framework: Well-positioned for future growth

For overseas asset managers, early licensing strategy is not a cost exercise—it is a risk management and governance decision.

Assessing the Appropriate Licensing Structure

Determining the correct type of intermediary and licensed individual requires a fact-sensitive assessment. The following considerations are typically central to that analysis:

- the nature and scope of regulated activities carried on in or from Hong Kong, including deal origination, client engagement, and execution;

- whether the business is ongoing or time-limited, and whether Hong Kong activities are integral to the firm’s core operations;

- the governance and staffing model, including who exercises decision-making authority and who bears supervisory responsibility; and

- the extent of cross-border involvement, and whether supervisory arrangements are effective and credible from a regulatory standpoint.

Early engagement with these issues allows firms to structure their licensing arrangements in a manner that reflects regulatory substance and avoids the need for remedial action at a later stage.

How Heinbro Can Help

Heinbro supports financial services firms with regulator-ready Type 9 licensing strategies, from initial licensing and immigration to ongoing compliance, inspections, and strategic growth.

To discuss your licensing or compliance requirements, get in touch with Heinbro at heinbro@heinbro.com or call +852 2811 1708 to arrange a free initial consultation.