The Open-Ended Fund Company regime was launched on 30 July 2018 after four years of market consultation to further enhance and diversify the fund platform in Hong Kong. It outlines the recent regulatory enhancement to amplify the regulatory environment for the OFCs. The Hong Kong OFCs must be registered with the Securities and Futures Commission and the Companies Registry. The legal capacity of an OFC is similar to that of a company under the Companies Ordinance.

Hong Kong OFCs offer five major advantages over offshore jurisdictions:

It enables fund owners to enjoy preferential tax treatment. There is no cap on relief for transactions incidental to qualifying transactions.

When an OFC uses the professional investor exemption, there is no minimum amount that each investor must invest.

Fund owner can dispense with the entire layer of Cayman service providers and pay lesser amount of government fees.

Private OFCs do not have to file their prospectus or marketing materials with the SFC. Compliance with anti-money laundering regulations is easier.

It offers greater legal certainty through asset and liability segregation as well. The assets and liabilities of each sub-fund will be legally segregated from each other.

Notwithstanding the advantages, some restrictions are imposed on Hong Kong OFCs which are absent in offshore jurisdictions:

The appointee must fulfill SFC-imposed eligibility requirements. Custodians must be either eligible under the UT Code or be the SFC Type 1 licensee fulfilling the OFC Code.

To become a director of an OFC, one must satisfy relevant requirements in order to receive approval from the SFC. There is also a lack of flexibility in management power distribution.

Certain post-registration changes require approval from the SFC. The change of name and material change to an instrument of incorporation requires the SFC approval.

The OFCs must appoint an investment manager. The manager must hold a Type 9 license and the appointment is subject to SFC's approval.

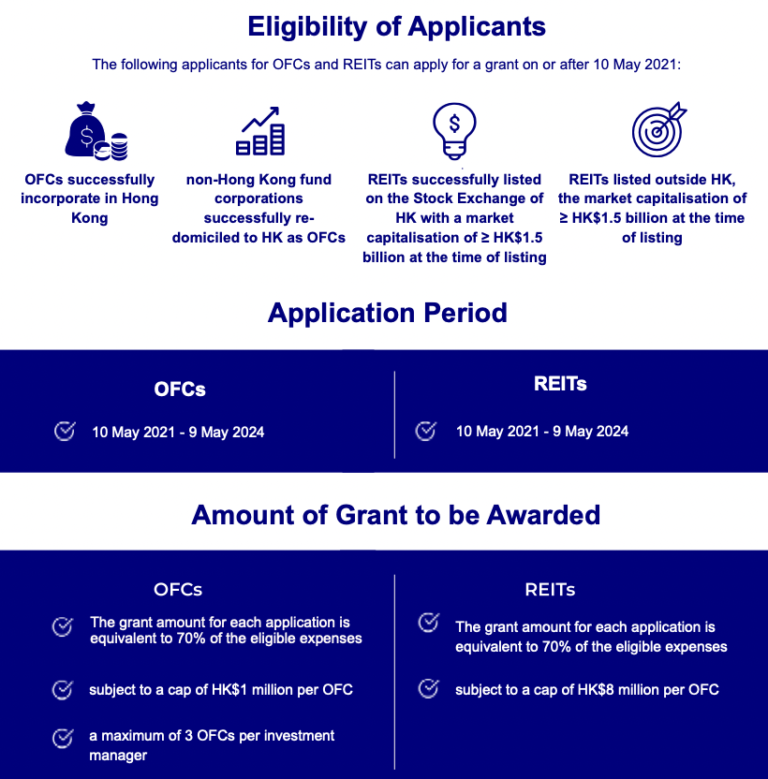

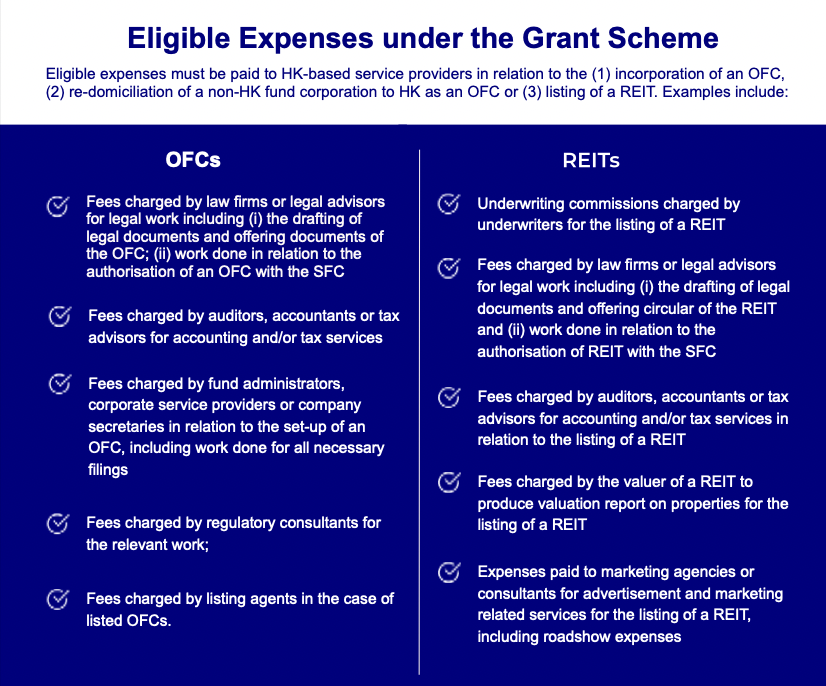

On 10 May 2021, the Securities and Futures Commission announced the implementation of the Government’s grant scheme to subsidize the setting up of open-ended fund companies and real estate investment trusts in Hong Kong. The regulatory authority has introduced a number of incentives to encourage local fund managers to set up onshore funds in Hong Kong. We will illustrate the details as follows.

We would assist in the registration of a private OFC regarding the following specific matters:-

Provide preliminary advice to management on the regulatory approval process and the specific requirements

Provide advice to the management on the requirements on the Key Operators of the OFC (Directors, Investment Managers, Custodians, etc.)

Assist in identifying and capturing all the regulatory issues and hurdles that may arise during the registration process

Advice on the key areas considered by the regulatory authorities (i.e. the SFC, CR, Inland Revenue Department, etc.) in approving the relevant application

Drafting of statutory documents (Instrument of Incorporation etc.)

Preparation of registration and incorporation documents for submission to relevant regulatory authorities

Preparation of appropriate cover letters in support of the registration

Assist senior management in responding to the queries raised by the regulatory authorities during their review of the registration documents

Assist on behalf and/or accompany management to any meetings with the regulatory authority in order to discuss any issues and concerns arising from the approval process

Our firm meets the requirements to be eligible for the grant as a Hong Kong-based consultancy firm.

We have substantial knowledge and experience dealing with the registration of OFCs, and successfully set up OFCs and are currently dealing with a number of applications for other clients.